Let's be honest: talking about money can feel like navigating a minefield. It's often shrouded in jargon, loaded with emotion, and can be a source of significant stress within households. But what if I told you that with a clear roadmap, Household Financial Planning could become one of the most empowering, unifying, and future-securing activities your family undertakes? It's not about restriction; it's about freedom, stability, and peace of mind.

Family financial planning is simply the art and science of organizing your money to meet today's needs while building a strong foundation for tomorrow's dreams. It’s about managing income, savings, and expenses with intention, ensuring stability, protecting your financial future, and significantly reducing stress by giving you a clear path forward. This guide isn't just about numbers; it's about empowering your family to thrive.

At a Glance: Your Pathway to Financial Peace

- Communicate, Communicate, Communicate: Open, honest conversations about money are non-negotiable.

- Goal-Oriented: Define clear short-term and long-term financial targets with specific amounts and deadlines.

- Know Your Cash Flow: Track where your money comes from and, more importantly, where it goes.

- Budget Smart, Not Hard: Create a realistic spending plan that aligns with your values and goals.

- Build Your Safety Net: Prioritize an emergency fund covering 3-6 months of living expenses.

- Automate Your Success: Set up automatic savings and investments to build wealth consistently.

- Plan for Every Horizon: Balance immediate needs with long-term goals like retirement and education.

- Tackle Debt Strategically: Develop a plan to reduce high-interest debt efficiently.

- Protect Your Legacy: Secure your family with adequate insurance and a robust estate plan.

- Start Early: Teach children financial literacy from a young age.

- Stay Agile: Regularly review and adjust your plan as life changes.

Why Household Financial Planning Is Your Family's Superpower

Think of your household's finances as a ship. Without a captain, a map, and a clear destination, you're at the mercy of the waves, adrift and vulnerable. Household financial planning gives you the helm. It's the difference between reacting to financial surprises and proactively preparing for them.

This strategic approach ensures your family has the resources not just to survive, but to truly flourish. It protects against unexpected job loss, medical emergencies, or market downturns. Moreover, it transforms vague aspirations into achievable milestones, whether that's buying a first home, funding college tuition, enjoying a comfortable retirement, or simply taking that dream vacation. The clarity and control a solid plan provides can dramatically reduce stress and allow you to focus on what truly matters: your family's well-being and shared experiences.

The Unsung Hero: Family Communication & Collaboration

The most robust financial plans often crumble without the bedrock of open family communication. Money discussions can be fraught with past experiences, different spending habits, and unspoken anxieties. However, making these conversations regular and transparent is the first, most crucial step.

Open Dialogue is Key: Set aside time, perhaps a regular "money talk" night, where everyone feels comfortable sharing their perspectives without judgment. Discuss your financial goals openly, ensuring everyone understands "why" certain decisions are being made. This fosters a sense of shared responsibility and unity.

Embrace Compromise: Every family member brings their own financial history and vision to the table. One partner might be a natural saver, the other a spender. Children might have immediate wants that clash with long-term savings. Be open to meeting in the middle. Compromise isn't about giving up; it's about finding common ground that respects individual needs while serving the collective family goal. Understanding each other's "money stories" can build empathy and pave the way for more productive discussions.

Regular "State of the Union" Meetings: Just like a business, your household benefits from regular check-ins. Quarterly meetings are ideal for reviewing your financial progress, discussing new goals, and making necessary adjustments. Importantly, involve your children in an age-appropriate manner. This isn't just about sharing information; it's about teaching them invaluable financial literacy skills. Even young kids can understand concepts like saving for a desired toy, learning to distinguish between needs and wants, and seeing the family work together towards a common financial aim. This early exposure helps them develop a healthy relationship with money, understanding its value and how to manage it responsibly.

Your Step-by-Step Blueprint for Financial Stability

Building a comprehensive household financial plan can feel like a big undertaking, but by breaking it down into manageable steps, you'll find it far more accessible and empowering. Think of these as the ten foundational pillars supporting your family's financial security.

1. Defining Your Financial North Star: Setting Clear Goals

Before you can chart a course, you need a destination. Financial goals give purpose to your budgeting and saving efforts. These aren't just vague wishes; they need to be specific, measurable, achievable, relevant, and time-bound (SMART).

- Short-term Goals (1-3 years): Think immediate needs and wants. This could be paying off a high-interest credit card, saving for a family vacation, or building a small emergency buffer. For instance, "save $5,000 for a down payment on a new car in 18 months."

- Long-term Goals (3+ years): These are the bigger life milestones. Retirement savings, college funds for children, buying a home, or starting a business fall into this category. An example might be, "save $100,000 for a child's college education by their 18th birthday."

Work together as a family to prioritize these goals. What's most important right now? What can wait a bit longer? Assign specific amounts and deadlines to each goal – this makes them real and actionable.

2. Where Does It All Go? Assessing Income and Expenses

You can't manage what you don't measure. This step is about gaining radical transparency into your current financial situation. It’s an exercise in awareness, not judgment.

- List All Income Sources: Include salaries, bonuses, rental income, side gigs, child support, or any other regular inflow of money. Get a clear picture of your total monthly net income.

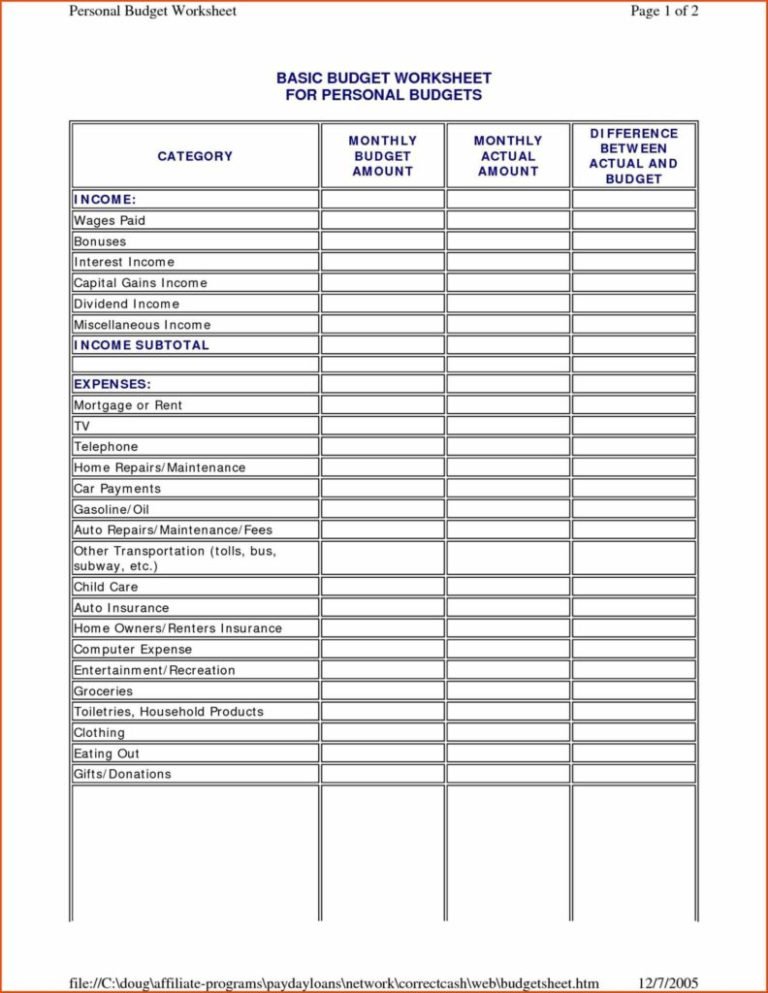

- Track Monthly Spending: This is where many people get uncomfortable, but it’s critical. For at least a month (or ideally, three months), track every dollar spent. Use budgeting apps, spreadsheets, or even a simple notebook. Categorize expenses (housing, utilities, groceries, transportation, entertainment, subscriptions, etc.). You'll likely discover "money leaks" – small, regular expenses that add up significantly over time. Understanding smart budgeting strategies often starts with this foundational step of tracking.

This assessment provides the raw data you need to make informed decisions about your budget.

3. Crafting a Budget That Actually Works

With your income and expense data in hand, you're ready to create a realistic budget – a spending plan that fits your family's needs and aligns with your goals. A budget isn't about deprivation; it's about conscious allocation.

- Assign Categories: Based on your tracking, allocate specific amounts to each spending category. The 50/30/20 rule is a popular starting point: 50% for Needs (housing, groceries, utilities), 30% for Wants (dining out, entertainment, hobbies), and 20% for Savings & Debt Repayment. Adjust this ratio to fit your unique circumstances.

- Track Every Dollar: Once your budget is set, stick to it. Regularly review your spending against your budgeted amounts. If you overspend in one category, look for ways to reduce spending in another.

- Set Limits on Non-Essential Spending: This is where conscious choices come into play. Can you cook more at home instead of eating out? Do you really need all those streaming services? Small adjustments here can free up significant funds for savings or debt repayment.

Remember, a budget is a living document. It will need adjustments as your life and income change.

4. Your Financial Safety Net: Building an Emergency Fund

If there's one non-negotiable component of household financial planning, it's the emergency fund. This dedicated pool of money is your first line of defense against life's inevitable curveballs.

- The Golden Rule: Aim to save 3 to 6 months' worth of essential living expenses (rent/mortgage, utilities, groceries, transportation, insurance premiums, minimum debt payments). For families with less stable income or higher risk factors, even 6-12 months might be prudent.

- Where to Keep It: This money should be in a liquid, easily accessible account, such as a high-yield savings account, separate from your everyday checking account. Avoid investing it in stocks or other volatile assets, as you might need it quickly and without loss.

- What It's For: Job loss, unexpected medical bills, car repairs, home repairs – these are the scenarios an emergency fund protects you from, preventing you from going into debt when unforeseen costs arise. Building a resilient emergency fund truly changes your financial outlook.

5. Set It and Forget It: Automating Your Savings

Consistency is key to wealth building, and automation is your best friend here. Make saving and investing a habit you don't even have to think about.

- Schedule Transfers: Set up automatic transfers from your checking account to your savings, emergency fund, and investment accounts immediately after payday. Even small, regular contributions add up significantly over time thanks to the power of compounding.

- Pay Yourself First: Treat your savings contributions like any other bill – a non-negotiable expense that gets paid first. This ensures that you're always making progress towards your financial goals before discretionary spending takes over.

6. Planning for Today, Investing for Tomorrow

Balancing immediate needs with long-term growth is crucial. Your money should work differently depending on its purpose and timeline.

- Short-Term Funds: For goals within the next 1-3 years (like a vacation or a car down payment), keep your money safe and accessible in high-yield savings accounts or short-term CDs. The focus here is capital preservation, not aggressive growth.

- Long-Term Investments: For goals 5+ years away (retirement, college), your money needs to grow. Inflation erodes purchasing power over time, so simply saving won't be enough. Investing in diversified portfolios of stocks, bonds, and mutual funds allows your money to compound and outpace inflation.

- Retirement Accounts: Maximize tax-advantaged accounts like 401(k)s, especially if your employer offers a matching contribution (it's free money!). Individual Retirement Accounts (IRAs) – both Traditional and Roth – offer additional options.

- The 15% Rule: A common guideline is to aim to save at least 15% of your income annually for retirement. The earlier you start, the less you'll have to save later, thanks to compound interest. Learning to manage these funds is part of demystifying investment options. For more specific guidance on navigating retirement savings, consider exploring detailed guides.

7. Investing in Futures: Education Savings

For many families, funding a child's education is a significant long-term goal. Planning for this early can make a world of difference.

- 529 Plans: These are tax-advantaged savings plans designed specifically for education expenses. Earnings grow tax-free, and withdrawals are tax-free when used for qualified education expenses (tuition, fees, books, room and board). They also offer flexibility, with up to $35,000 able to be rolled into a Roth IRA for the beneficiary if college plans change.

- Taxable Investment Accounts: While 529s offer tax benefits, a taxable brokerage account provides more flexibility. If your child decides not to attend college, or if they receive scholarships, the funds can be used for any purpose without penalty, though gains will be subject to capital gains taxes. Financial advisors can help you structure these accounts to minimize taxes.

- Custodial Accounts (UGMA/UTMA): These accounts allow a minor to own assets, with an adult custodian managing them until the child reaches legal age. While they offer flexibility, they can impact financial aid eligibility and the child gains full control at adulthood, which may not always be ideal.

8. Taming the Debt Monster

Debt, especially high-interest debt like credit cards, can be a major roadblock to achieving your financial goals. Developing a strategic plan to pay it down is essential.

- Prioritize More Than Minimums: Always aim to pay more than the minimum payment on your debts. This reduces the principal faster and saves you a significant amount in interest over the long run.

- Target High-Interest Debts First (Avalanche Method): List all your debts from highest interest rate to lowest. Focus all your extra payments on the debt with the highest interest rate while making minimum payments on the others. Once the highest-interest debt is paid off, roll that payment amount into the next highest. This method saves you the most money in interest.

- Target Smaller Debts First (Snowball Method): Alternatively, list your debts from smallest balance to largest. Focus all your extra payments on the smallest debt, making minimum payments on the rest. Once the smallest debt is paid off, roll that payment amount into the next smallest. This method provides psychological wins that can keep you motivated, even if it costs slightly more in interest.

- Automate Payments: Set up automatic payments to avoid late fees and ensure consistency. If you're looking for detailed strategies, explore effective debt management techniques.

9. Protecting What Matters Most: Insurance & Estate Planning

Financial planning isn't just about accumulating wealth; it's also about safeguarding it and ensuring your loved ones are cared for in any circumstance.

- Insurance:

- Life Insurance: If you have dependents, life insurance is crucial. It provides a financial safety net that can replace your income, cover debts (mortgage, loans), fund children's education, and cover final expenses in the event of your death. Evaluate how much coverage you truly need to protect your family's lifestyle. There are many types, so understanding understanding life insurance options is a key part of this step.

- Other Coverage: Regularly review your health, auto, home, and disability insurance to ensure you have sufficient coverage without overpaying. Disability insurance, in particular, can be a critical safeguard for your income if you're unable to work.

- Estate Planning: This might sound intimidating, but it's simply planning for what happens to your assets and dependents if you're no longer able to manage them.

- Wills: A will ensures your assets are distributed according to your wishes and allows you to name guardians for minor children.

- Trusts: Trusts can offer more control over how and when assets are distributed, potentially avoid probate, and offer tax advantages.

- Power of Attorney & Healthcare Directives: These documents designate someone to make financial and medical decisions on your behalf if you become incapacitated.

- Beneficiaries: Ensure all your financial accounts (retirement, life insurance) have up-to-date beneficiaries named. This often bypasses probate. For a deeper dive into the basics of estate planning, consulting legal professionals is highly recommended.

10. Raising Money-Smart Kids: Financial Education

Financial literacy starts at home. Empowering your children with sound money principles from an early age is one of the greatest legacies you can leave them.

- Start Early with Age-Appropriate Lessons:

- Preschoolers: Introduce concepts of saving and spending using piggy banks and simple allowances.

- Elementary Schoolers: Explain the value of money, the difference between needs and wants, and the concept of earning through chores or small tasks. Involve them in shopping decisions.

- Teens: Introduce more complex ideas like budgeting for specific items, understanding compound interest through small investments, and perhaps even opening a custodial investment account to expose them to the stock market.

- Involve Children in Discussions: Remember those "state of the union" meetings? Let them participate. Explain family financial goals (e.g., "We're saving for a new roof, so we're limiting dining out for a bit"). This transparency demystifies money and shows them real-world application of financial planning.

- Lead by Example: Your financial habits will speak volumes. Let them see you budgeting, saving, and making intentional financial choices. Providing hands-on lessons about money will set them up for a lifetime of financial confidence. If you're looking for practical ways for teaching kids about money, there are abundant resources available.

Keeping Your Plan Alive: Ongoing Management

Your household financial plan isn't a "set it and forget it" document; it's a living guide that needs regular attention. Life changes – incomes fluctuate, expenses rise, goals evolve, and market conditions shift.

- Evaluate and Adjust Regularly: Schedule annual (or even quarterly) reviews of your budget, savings progress, and investment performance. Are you still on track for your goals? Do you need to reallocate funds? Has your risk tolerance changed?

- Adapt to Life Events: Major life events like marriage, divorce, having children, job changes, or significant medical issues all warrant a re-evaluation of your financial plan. These are moments to pause, assess, and make necessary adjustments to ensure your plan still serves your family's best interests.

- Professional Guidance: While much of financial planning can be managed DIY, for complex decisions (e.g., intricate investment strategies, significant estate planning, business finances), a certified financial planner (CFP) can be an invaluable resource. They can provide tailored advice, identify blind spots, and help you optimize your plan for efficiency and tax advantages. Don't hesitate to seek expert help when the stakes are high.

Common Pitfalls to Sidestep on Your Financial Journey

Even with the best intentions, families can stumble. Being aware of common mistakes can help you navigate around them.

- Ignoring Long-Term Goals: It’s easy to focus on immediate needs, but neglecting retirement or college funds until later dramatically increases the effort required. Start saving for these goals early, even if it's a small amount. Time and compound interest are your most powerful allies.

- Failing to Involve All Family Members: When one person shoulders the entire financial burden, it breeds resentment and can lead to misunderstandings. Financial planning is a team sport; everyone needs to be on the same page, even if roles differ.

- Overlooking the Impact of Inflation: What $100 buys today will buy less in 20 years. Inflation is a silent wealth killer. Your financial plan must account for rising costs, especially for long-term goals like retirement and college, where investments need to outpace inflation to maintain purchasing power.

- Neglecting Early Financial Education for Children: This oversight can have profound effects. Children who aren't taught about money often struggle with debt, budgeting, and investing in adulthood, missing out on crucial growth opportunities and perpetuating cycles of financial stress.

Your Next Steps to Financial Freedom

Household financial planning isn't a quick fix; it's an ongoing journey toward stability, security, and the freedom to live the life you envision for your family. By embracing communication, setting clear goals, and diligently following these steps, you're not just managing money – you're building a stronger, more resilient future.

Start today. Pick one step from this guide – perhaps setting your first SMART goal, or tracking your expenses for a week. The momentum you build will be your greatest asset. And remember, you don't have to tackle this alone. Many resources exist to help you on your path to financial mastery, from budgeting tools to financial advisors. Explore comprehensive resources like Your guide to the man in house for broader insights into managing your household effectively. Your family's financial future is in your hands, and with a solid plan, it's brighter than you think.